Well, that’s not the news we were hoping to wake up to.

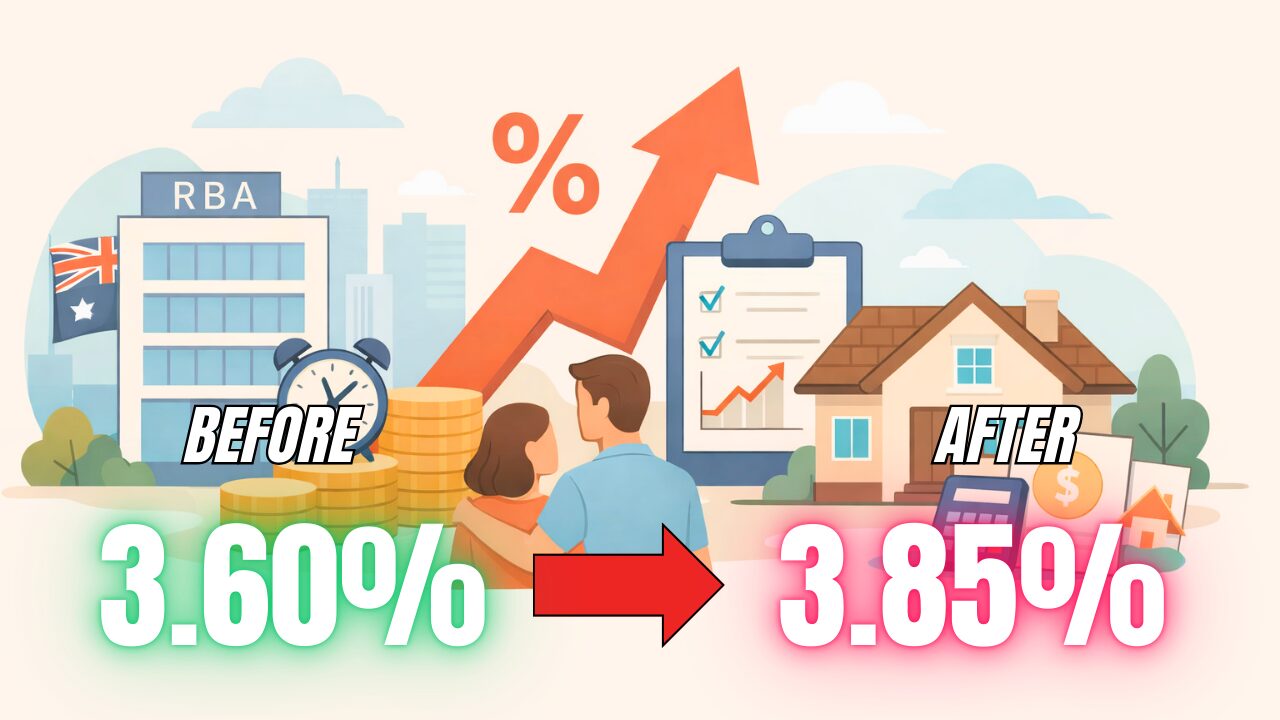

The Reserve Bank of Australia (RBA) just raised the official cash rate by 0.25%, bringing it to 3.85%. This is the first hike we’ve seen in 2026, and honestly? It’s a bit of a plot twist after a year where we actually saw a few rate cuts.

If you’re sitting there thinking “Wait, didn’t we just catch a break?”, yep, we feel you. But before you spiral into mortgage math panic, let’s break down what actually happened, why it happened, and what it means for your home loan (or your next property move).

Deep breath. We’ve got you.

So… What Exactly Happened?

On Tuesday, February 3rd, 2026, the RBA board made a unanimous decision to bump the cash rate up by 0.25 percentage points. The new rate? 3.85%.

This is the first increase since the post-COVID inflation rollercoaster, and it comes after a period where the RBA had actually been lowering rates throughout 2025. In other words, we got a little relief… and now we’re tapping the brakes again.

To be fair, it wasn’t a total shock. Financial markets had already priced in a 75% chance of a rate rise before the announcement, and most economists had been tipping it for weeks. Still, knowing it’s coming doesn’t make the reality sting any less when you’re the one with a variable rate mortgage.

Why Did the RBA Hike Rates?

One word: inflation.

Australia’s inflation rate jumped to 3.8% in October 2025, which sits firmly outside the RBA’s target band of 2–3%. Core inflation (the one that strips out volatile stuff like fuel and food) also crept up to 3.3%.

The RBA’s job is to keep inflation under control, and when prices start climbing too fast, they pull the interest rate lever to cool things down. Higher interest rates = more expensive borrowing = less spending = (hopefully) slower price growth.

Translation? The economy’s been running a bit too hot, and the RBA decided it needed to tap the brakes before things overheated.

According to the RBA’s statement, “some of the increase in inflation reflects greater capacity pressures.” Basically, businesses are struggling to keep up with demand, which pushes prices higher. And inflation is expected to hang around above target for a while yet.

Not ideal. But also not entirely unexpected given how bumpy the economic recovery has been.

What Does This Mean for Your Mortgage?

Let’s get to the part you’re really here for – how does this affect your home loan?

If you’re on a variable rate mortgage, your repayments are about to go up. Most lenders will pass the RBA’s rate increase through to customers within a few weeks, which means your monthly repayment will climb.

How much? That depends on your loan size, but as a rough guide, a 0.25% increase on a $500,000 loan adds around $75–$80 per month to your repayments. Not catastrophic, but definitely noticeable when you’re already juggling bills, groceries, and petrol prices.

If you’re on a fixed rate, you’re safe, for now. Your rate is locked in until your fixed term ends. But when it does come time to refinance or roll onto a variable rate, you’ll be dealing with this higher rate environment.

And if you’re a first home buyer or investor eyeing your next move? Your borrowing power just took a small hit. Lenders assess how much you can afford based on interest rates, so a rate hike means you might qualify for slightly less than you would have a month ago.

Fun times, right?

A Little Perspective (Because Doom-Scrolling Helps No One)

Okay, yes, rate hikes aren’t fun. But let’s zoom out for a second.

3.85% is still historically pretty reasonable. Remember when rates were sitting above 5% a few years ago? Or when your parents bought their first home in the ’80s and rates were in the double digits? (Wild, we know.)

Also, the RBA is projecting that longer-term rates will trend downward over the next couple of years, possibly settling around 3.60% by 2027 and 3.10% by 2028. So this hike might be a short-term speed bump, not the start of a long climb.

And here’s the thing: rates go up and down. That’s how the system works. The key is making sure your mortgage can handle a bit of movement, and that you’ve got a plan in place to navigate the bumps.

Which brings us to…

What Should You Do Now?

Alright, enough doom and gloom. Let’s talk action steps.

1. Check Your Current Loan

When was the last time you actually looked at your mortgage? If it’s been a while, now’s a good time to review your rate, your repayment structure, and whether you’re still getting a competitive deal. You might be surprised at how much rates and products have shifted since you first signed up.

2. Stress-Test Your Budget

Can you comfortably absorb the rate increase? If your repayments are already tight, it’s worth sitting down and figuring out where you can create a buffer, whether that’s cutting back on discretionary spending or looking at ways to boost your income.

3. Consider Fixing (If It Makes Sense)

If you’re currently on a variable rate and you’re worried about further hikes, switching to a fixed rate might give you some peace of mind. Just make sure you’re locking in a rate that’s genuinely competitive, and that you understand the trade-offs (like limited offset account access or break fees if you need to refinance early).

4. Explore Refinancing Options

If your current lender isn’t giving you a great deal, it might be time to shop around. Refinancing can save you thousands over the life of your loan, and a broker (hi, that’s us) can help you find a better rate without all the admin headaches.

5. Get Pre-Approval Before You Buy

If you’re still hunting for a property, having pre-approval is more important than ever. It locks in your borrowing power now, so you’re not scrambling to adjust your budget while you’re negotiating on a place you love.

How More Than Mortgages Can Help

Look, we get it. Rate hikes are stressful. Mortgages are complicated. And the last thing you want to do is wade through comparison sites and call centers trying to figure out your best move.

That’s where we come in.

At More Than Mortgages, we’re not just about getting you a loan: we’re about making sure it actually works for your life. Whether you need a loan review, a refinance, or a fresh pre-approval, we’ll take the time to understand your situation and find a solution that fits.

No cookie-cutter advice. No jargon overload. Just real conversations and personalised strategies that help you stay on top of your mortgage, even when the RBA throws a curveball.

Here’s What We Can Do:

- Loan Health Check: We’ll review your current mortgage and see if there’s a better deal out there (spoiler: there often is).

- Refinancing Options: If your rate’s not competitive, we’ll help you switch to something better without the stress.

- Pre-Approval Support: Lock in your borrowing power now so you can shop with confidence.

- Borrowing Power Calculator: Not sure how much you can borrow after the rate hike? Check our calculator here and get a clear picture in minutes.

- Investor Advice: If you’re looking to grow your property portfolio, we’ll help you navigate the numbers and find smart finance solutions. Learn more about our property investment services.

Let’s Talk

Rate hikes are part of the deal when you’ve got a mortgage. But that doesn’t mean you have to figure it out on your own.

If you’re feeling unsure about your next move: or you just want someone to crunch the numbers and give you straight answers: book a chat with us. We’ll walk you through your options, explain what’s actually realistic, and help you build a plan that works.

Because navigating your mortgage shouldn’t feel like solving a Rubik’s cube blindfolded. (Though honestly, at this point, it kind of does.)

You’ve got this. And if you need a hand? We’ve got you.

Disclaimer: This article is for general information only and does not constitute financial advice. Your individual circumstances matter, and we recommend speaking with a qualified mortgage broker before making any major financial decisions. That’s us, by the way. Let’s chat.